An audit committee is one of the main committees that are a part of the company’s board of directors. Its key function is to ensure that an organization is accountable in all business matters and establish effective corporate governance.

The importance of an audit committee is also reflected in the evolving board priorities, with cybersecurity being the focus. This is because an audit committee is responsible for managing cybersecurity practices inside a company, according to Deloitte’s survey.

So what is the role of an audit committee in corporate governance? What are the key responsibilities of an audit committee, and how is it regulated? Find out in this article.

Discover effective management tool for your board

Rely on our choice – Ideals Board

Visit WebsiteWhat is an audit committee?

An audit committee is one of the major subcommittees of a company’s board of directors responsible for overseeing financial reporting, compliance, and risk management. It coordinates with the executive committee, internal auditors, and independent auditors to monitor the company’s choice of accounting principles and policies to ensure compliance with core laws and regulations.

Thus, an audit committee plays an integral role in the organization’s overall corporate governance, as it ensures that the company is accountable in almost all aspects: from internal and external audits to the company’s financial reporting and risk management. This, in turn, helps to establish trust among stakeholders.

An audit committee is made up of independent outside directors, with at least one being qualified as a financial expert. An audit committee is appointed by the board and usually comprises three or seven board directors who are not involved in the company’s management.

Top 5 audit committee responsibilities

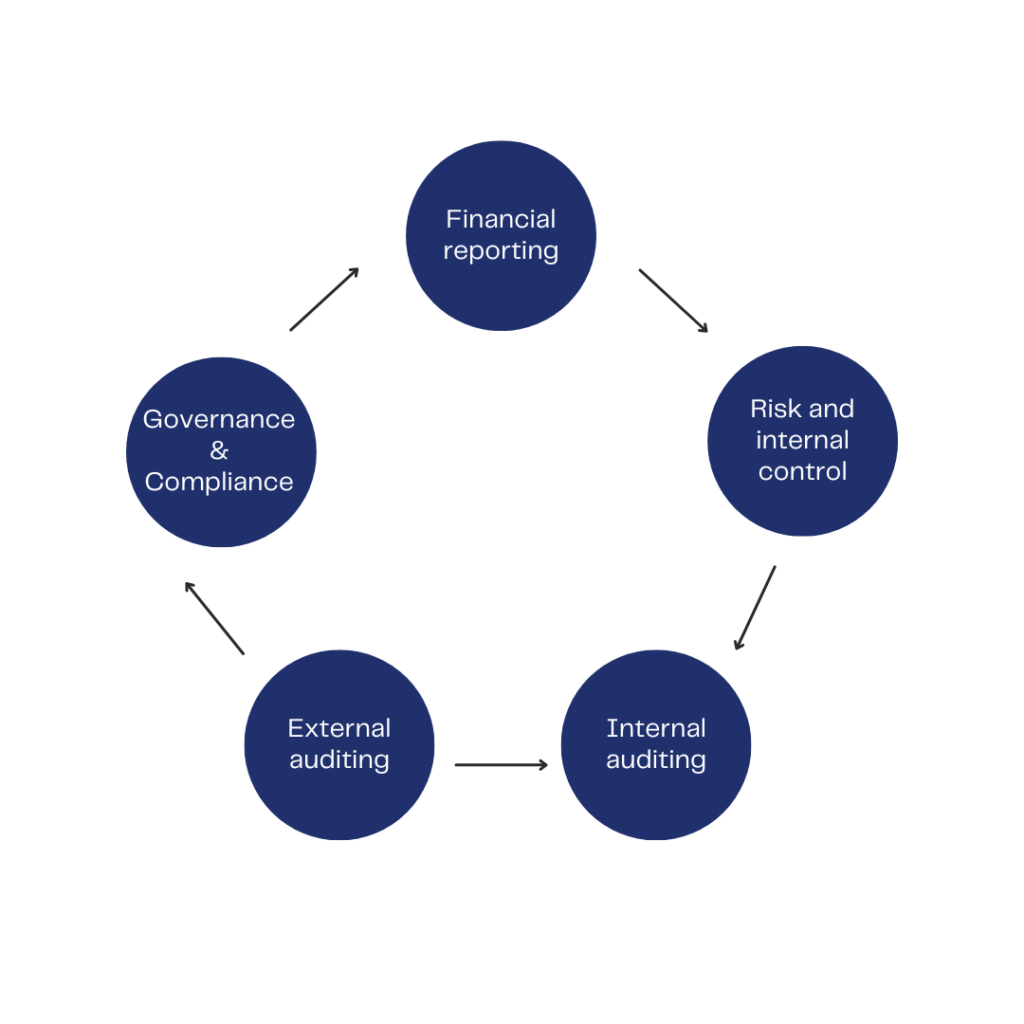

So, what does an audit committee do? The key areas of audit committee duties include the following:

- Financial reporting oversight

- Risk management and internal controls

- Internal audit oversight

- External audit oversight

- Governance and compliance

Let’s now review in more detail what duties of audit committee each of these focus areas presupposes.

1. Financial reporting oversight

The oversight of the financial reporting process is a key responsibility of audit committee. Audit committee members review financial statements, a balance sheet, income statement, cash flow statement, and other financial reports and notes of the company. This is done to ensure all documents are in order and represent accurate data about the organization’s financial position and performance.

An audit committee member is also responsible for assessing the completeness of all company’s financial reports. It includes ensuring that all the information about contingencies, transactions, and accounting policies is properly presented.

2. Risk management and internal controls

The audit committee’s risk oversight includes ensuring that an organization has all the necessary mechanisms and controls in place to manage risk, safeguard assets, and prevent any kind of fraud.

Audit committee members review internal risk assessments and control reports and then, discuss the outcomes with the management team and internal auditors.

3. Internal audit oversight

The audit committee also controls the internal audit. By this, the audit committee members oversee the company’s internal processes and operations and make valuable suggestions on how those processes can be improved.

For effective audit committee oversight, a company also needs to enlist an independent auditor. This ensures the transparency and integrity of the audit process.

4. External audit oversight

The audit committee also cooperates with external auditors when there’s a need to discuss certain issues privately.

Audit committee members are responsible for overseeing the hiring, performance, and independence of external auditors to ensure the transparency of the audit process.

5. Governance and compliance

One of the audit committee functions is also to ensure that an organization operates in compliance with major laws and regulations.

An audit committee reviews compliance programs, assesses their effectiveness, and identifies areas for improvement. It also monitors all the changes and developments in regulations and laws that apply to the organization and can affect its effectiveness. Audit committees assess the impact those changes can bring to the organization.

| Note: Explore how the areas of an audit committee’s responsibilities can look like in the audit committee oversight checklist provided by PwC. |

Role of audit committee in corporate governance

An audit committee plays a crucial role in an organization’s corporate governance. This is because audit committee members hold the board and organization accountable in almost all areas: from internal and external audits to financial reporting and risk management.

Additionally, an audit committee closely cooperates with other committees, such as the board development committee, nominating committee, cyber committee, risk committee, and remuneration committee. This ensures that the organization stays effective on all levels.

Audit committee reporting

Just like any other committee, an audit committee reports to the board of directors. The audit committee roles and responsibilities as well as an audit committee purpose and reporting lines are usually described in the charter for a committee.

Audit committee meetings are held regularly during the year. Typically, an audit committee meets at least three times a year: before an audit, when the draft financial statements are ready, and after the audit process. It’s an audit committee chair who decides when it’s time to meet.

Looking for a audit committee agenda examples?

Download our template and use it for your next board meeting.

DownloadAudit committee members’ requirements and skill set

62% of audit committee chairs have a strong financial background, including public accountant executives, CFOs, investors and bankers, and other financial corporate leaders. 25% of audit committee chairs are retired chairs, CEOs, vice presidents, and COOs.

What are other audit committee requirements for an individual to become an audit committee member? This is the list of traits that are required for an effective audit committee member:

- Intellectual curiosity. To stay objective and ensure quality oversight of the internal and external operations of a company, an audit committee member should ask the right questions and be able to review each aspect of the business.

- Decision-making skills. An audit committee member should be able to make tough decisions, such as appointment of new external auditors, assembling the team, and re-organizing the overall internal audit approach.

- Ethical approach to whistleblowing. The oversight of the whistleblowing process is one of the extra functions of audit committee. It means that audit committee members should manage the whistleblowing inside an organization and ensure that this process is balanced, effective, and yet ethical.

- Good listening skills. To be able to review all the processes inside the company, an audit committee member should be a great listener. This is important both when gathering the required information and taking part in the audit committee meetings.

- Attention to detail. The key to an effective oversight process is to be able to identify all the gaps and find room for improvement. That’s why an audit committee member should be attentive to detail.

Real-world examples of successful audit committees

Let’s take a look at a few examples of world-renowned companies’ audit committees:

- Microsoft. Microsoft is often recognized for its strong corporate governance practices, and its audit committee definitely contributes to it. Find out more about Microsoft’s audit committee composition and charter here.

- Pfizer. Pfizer’s audit committee is responsible for the oversight of the integrity of the company’s financial statements, internal controls, compliance, and more. Explore Pfizer’s audit committee’s compositions and its charter here.

- Johnson & Johnson. Johnson & Johnson is often cited as the company with a strong audit committee. Its audit committee function is to provide oversight of the financial management, and financial reporting procedures of the company, and independent auditors. Learn more about Johnson & Johnson’s audit committee composition and responsibilities on their website.

Role of the audit committee in evolving regulatory standards

Changes in regulatory requirements can significantly impact the roles of audit committees. This influence can be seen in various areas: from increased oversight responsibilities to proactive response to emerging issues. To stay in compliance with evolving standards, an audit committee should consider the following strategies:

- Continuous education and training. To stay abreast of new regulations and emerging best practices, audit committee members should engage in continuous education and training programs. This will ensure that they have the required knowledge, are aware of the latest regulatory changes, and can proactively react to those changes in their operations.

- Regular charters review and update. To align with the latest regulatory requirements, an audit committee should also regularly review and update its charter. This includes clarifying the committee’s scope, responsibilities, and reporting lines.

- Regular evaluation of the committee’s composition. To ensure that an audit committee comprises individuals with diverse skills and experiences relevant to the evolving regulatory landscape, an audit committee composition should be regularly reviewed. It might be helpful to engage members with expertise in emerging areas, such as data privacy or sustainability reporting.

- Technology solutions implementation. To enhance the efficiency of audit committee processes, it’s recommended that an audit committee leverages technology solutions. This is especially applicable in such areas as data analytics, internal controls monitoring, and cybersecurity. One of such technology solutions is a board portal. With its help, audit committees can securely manage large volumes of data and collaborate with each other and the board of directors in one cloud space.

| Tip: Explore the variety of modern board portals on our main page. |

Best practices for audit committees to excel in their roles

For a board of directors audit committee to stay effective and professional, consider the following tips:

- Meet regularly. To stay abreast of organizational developments and ensure a quality oversight of the company’s operations, an audit committee should meet regularly. For this, define the frequency of the meetings in the committee charter and set an annual meeting calendar.

- Maintain transparent communication with stakeholders. Open and transparent communication with stakeholders, including shareholders, regulators, and internal and external auditors is key to a collaborative atmosphere and successful oversight process.

- Conduct regular assessments. This corresponds both to the audit committee’s composition and expertise. By doing so, an audit committee stays effective and has the required expertise depending on the regulatory changes.

- Ensure independence and objectivity. This is crucial in order to avoid conflicts of interest and maintain impartiality in decision-making.

Key takeaways

Let’s summarize the key points from the article:

- An audit committee is a subcommittee of the board of directors that is responsible for overseeing financial reporting, risk management, and compliance management.

- To ensure a company is accountable in most business aspects, an audit committee cooperates with other committees, management teams, and internal and external auditors.

- The main responsibilities of audit committees include financial reporting oversight, risk management and internal controls, internal audit oversight, external audit oversight, governance and compliance, Additionally, they also manage the whistleblowing process inside the organization.

Time to use the modern board management software!

Ideals Board serves board of directors, committee members with a comprehensive suite for governance tools

Visit WebsiteFAQ

Why should the audit committee be independent?

This is important to avoid conflicts of interest and ensure the integrity of the audit process.

What is the central responsibility of the audit committee in a public company?

For public companies, the central purpose of an audit committee is to ensure oversight of the financial reporting, risk management, internal and external audit, and ethics and compliance.

Who does an audit committee report to?

Just like other types of committees, an audit committee reports to the company’s board of directors.